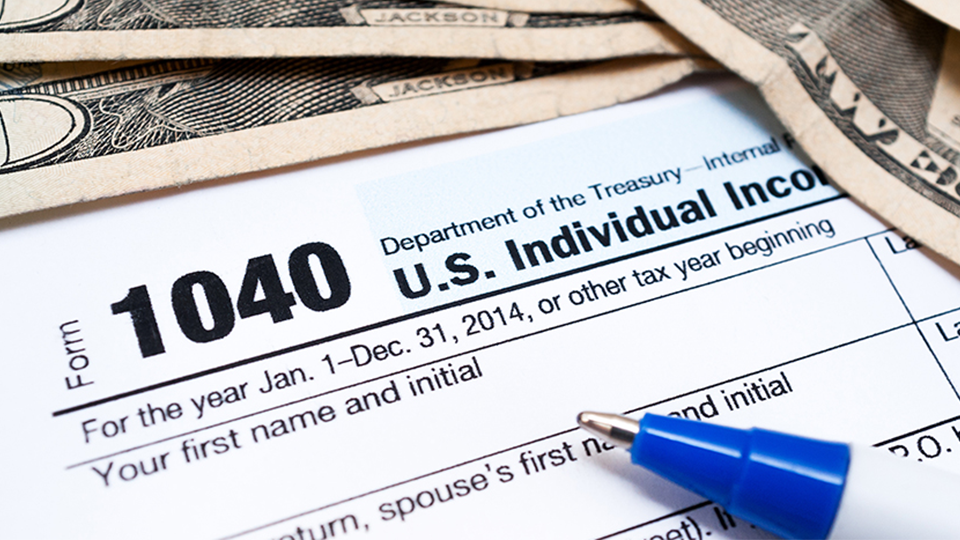

Most rational people would not decide to pursue a new career just because of that career's potential tax benefits. However, when you choose to become an insurance agent, one of the lesser-known perks is the ability to take a number of deductions on your tax filings, helping to lessen the amount you owe.

To be considered an eligible tax deduction, an expense must be both "ordinary" and "necessary." An insurance agent could probably not deduct an expense that had nothing to do with his or her insurance business. Here are six popular tax deductions for insurance agents:

1. Continuing education

Obtaining and maintaining your insurance licenses and any related certifications doesn't come cheap. The good news is that you can deduct the amounts you pay for things like license renewal costs, continuing education coursework and materials, certifications, subscriptions to industry publications and journals, and any other expense you pay to help further your career in the insurance industry.

2. Office space

In addition to eliminating your commute time and giving you added work/life flexibility, working from home as an insurance agent also has some tax deduction potential. You will want to talk to your accountant about the best way to take your home office deduction, as there is both a simplified method - based on the square footage of your office compared to the square footage of your house - and a more detailed method that allows you to deduct actual expenses for things like:

-

Heat, lights, water, sewer, and other utilities

-

Certain telephone and internet expenses

-

Repairs to, or expenses of refinishing, your office space

-

Office furniture, including your desk, chair, file cabinets, etc.

3. Office equipment and supplies

You need certain equipment and materials in order to be able to do your job. The IRS states that you may deduct your costs for expenses including:

-

Computer hardware and software

-

Scanners, printers, and ink

-

Printer and copy paper, stationary, pens, staplers, paper clips, file folders, and other materials that are ordinary and necessary for your work

-

Postage and stamps, including expenses for overnight or express deliveries

-

Greeting cards that you send to your clients or centers of influence

4. Vehicle Expenses

If you are using a vehicle to meet with clients,attend agency meetings and continuing education classes, or other business-related use, you can take a deduction. You will want to keep track of the following expenses so that preparing and filing your return is easier:

-

Miles driven

-

Parking and tolls

-

Registration fees

-

Gas and oil

-

Repairs

-

Depreciation

5. Travel expenses

If you need to travel to meet with clients, be sure to save documentation of your expenses. You may be able to deduct one-half of meals and entertainment in addition to airline tickets, rental car expenses, hotel costs, baggage fees, tips, taxi fares, and other travel-related costs.

6. Insurance expenses

You may also be able to take tax deductions for the amounts you spend on your health insurance, dental insurance, long-term care insurance, professional liability insurance (E&O), car insurance, homeowners insurance, and business insurance policies you maintain.

As with any type of tax-related matter, you will need to consult with an accounting or tax professional to explore which deductions you might be able to take, and to what extent those deductions affect your tax bill. In general, most insurance agents are able to lower their tax liability by keeping careful records of all of their business-related spending.

Is a Career as a Symmetry Financial Group Insurance Professional Right for You?

Independent insurance agents who

work with Symmetry Financial Group

can not only take advantage of a variety of flexibility and benefits including the tax deductions mentioned above; they can also get the satisfaction that comes from knowing they are helping meet clients' insurance needs by providing valuable protection against unforeseen events.

To learn more about why Symmetry Financial Group is one of the fastest-growing IMOs in the United States,

contact us

. You could be taking advantage of some or all of these deductions on your next tax return.